kansas sales and use tax exemption form

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Tax Policy and Statistical Reports.

Sales Tax Laws By State Ultimate Guide For Business Owners

You will need to present this certificate to the vendor from whom you are.

. In addition the Department has established a dedicated phone line specifically for the COVID-19 Retail. Send the completed form to the seller and keep a copy for your records. Complete a Kansas Business Tax Application.

How to use sales tax exemption certificates in Kansas. For non-profits that have received a sales tax exemption certificate from the Kansas Department of Revenue the exemption certificate is good only from its effective date. Or Designated or Generic.

Municipal governments in Kansas are also allowed to collect a local-option sales tax that. Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify. Or else a third party revenue exemption papers should be introduced with the employee.

Therefore you can complete the resale exemption certificate form by providing your Kansas Sales Tax Registration Number. For corporations whose business income is solely within state boundaries the tax is 4 of net income. The below-listed states have indicated that this certificate is acceptable as a resaleexemption certificate for salesuse tax subject to the instructions.

Kansas has a statewide sales tax rate of 65 which has been in place since 1937. For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates. Sales and use tax.

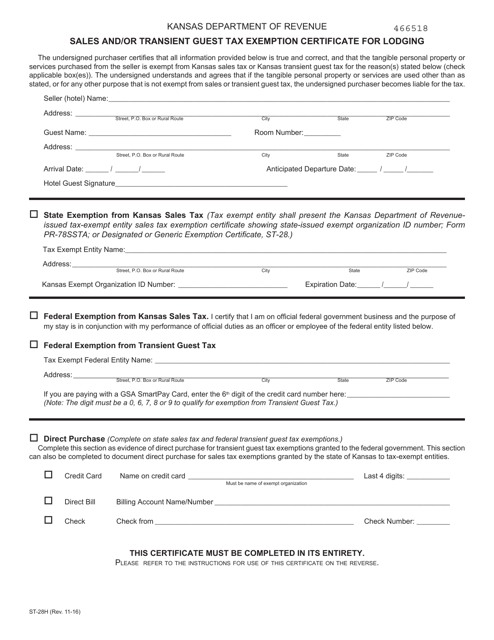

Destination-based sales tax information. Kansas Department of Revenue-issued tax-exempt entity sales tax exemption certificate showing state-issued exempt organization ID number Form PR-78SSTA. Declaration of Representative PV-AP-9 Downloadable Sales Validation Questionnaire Certificate of Value KCAAPVD Course.

Claimants have until April 15 2023 to file an application for this financial assistance. Streamlined Sales Tax Certificate of Exemption. Streamlined Sales Tax Certificate of Exemption Do not send this form.

In addition net income in excess of 50000 is subject to a 3. LoginAsk is here to help you access Kansas Sales Tax Registration Form. This is a multi-state form for use in the states.

These apply to state and local sales and use tax. Whenever a worker engages in exterior product sales action this type is necessary. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax.

File withholding and sales tax online. Step 2 Identify the sellers name business address Sales Tax Registration Number and a general. Name Telephone Number Contact Person Doing Business As Name.

Step 1 Begin by downloading the Kansas Resale Exemption Certificate Form ST-28A. Kansas Department of Revenue Home Page. Your Kansas Tax Registration Number 000-0000000000-00.

Kansas Sales Tax Registration Form will sometimes glitch and take you a long time to try different solutions. Application for Deferral Military of Real Property Taxes. Information provided in the form is true and correct and that you have read these instructions and further understand that in the event the property or service so purchased is not used in.

Do not send this form to the Streamlined Sales Tax Governing Board.

Iowa Resale Certificate Fill Out Sign Online Dochub

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

How To Get A Sales Tax Exemption Certificate In Arkansas Startingyourbusiness Com

Kansas Exemption Certificate Form Fill Out And Sign Printable Pdf Template Signnow

Printable Missouri Sales Tax Exemption Certificates

Fill Free Fillable Kansas Department Of Revenue Pdf Forms

Kansas Nonprofit Filing Requirements Ks Nonprofit Registration Annual Report

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

Form Ks 1520 Fillable Sales Tax Exemption Information And Certificates

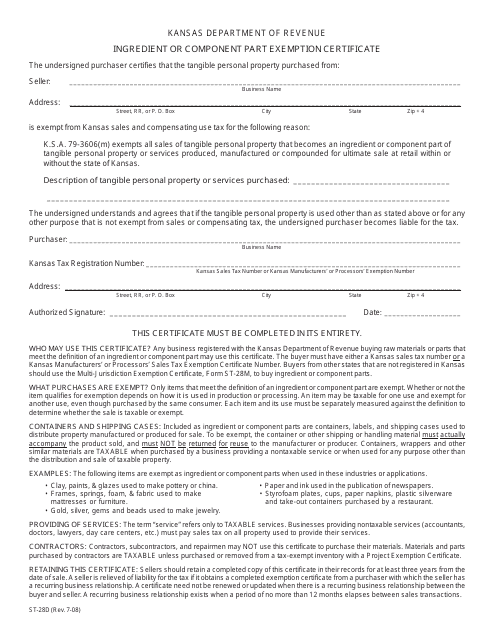

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

Missouri 149 Sales And Use Tax Exemption Certificate

Download Business Forms Premier1supplies

Form Ks 1528 Fillable Kansas Application For Sales Tax Exemption Certificates

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Form St 8b Fillable Affidavit Of Delivery Of A Motor Vehicle Semitrailer Pole Trailer Or Aircraft To A Nonresident Of Kansas

Kansas State Form W 4 Download